The Full In-Depth LiveJasmin Review 2021.

If you are looking for an adult site that will provide you with the best adult entertainment, then LiveJasmin is one of the sites that you should consider checking out. This platform features webcam performances by boys and girls that normally revolve around dirty talk, masturbation, and striptease.

Most of the models from this platform are spread across the world and a lot of them speak different languages so you won’t have to worry about any language barriers.

This platform was founded in the year 2001 by György Gattyán, a Hungarian electronic commerce entrepreneur. Since then, LiveJasmin has grown rapidly to become one of the most preferred, beautiful, and trusted cam sites across the world.

It comes with a convenient, easy-to-use, and well-designed multilingual interface. As a first-time user, you might get frustrated by the seemingly lots of settings and the amount of information displayed on its interface.

However, this is no course for worry as these are just simple tools to make it easier for you to customize the settings to your liking. It will only take you a little time before you get familiar with all these tools and continue enjoying the benefits this platform has to offer.

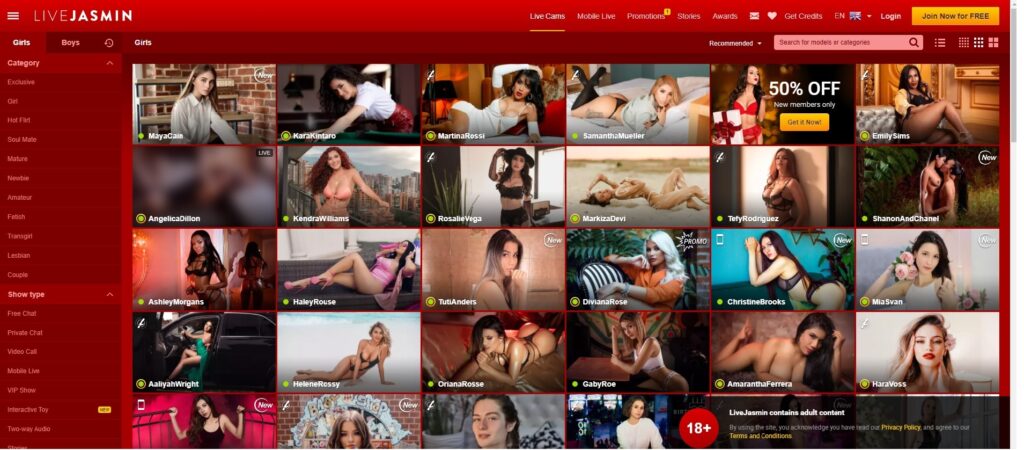

What is the interface like?

LiveJasmin’s trademark interface features a deep red color that is bound to entice and attract its users to log in and choose any model they would like to watch from the list provided. The interface is intelligently designed to balance the huge amount of skin being displayed through sensual photos and videos by models with refinement and classiness.

Taking your first glance at the platform you will get the feeling that it does not come out as shady and trashy even with all the nudity on display on this platform. It is packed with a lot of features specially made to make your experience as good as possible. However, to use some of these features, you will be required to pay for them.

This platform is your ultimate one-stop for adult entertainment and the best thing about it is that you can also get to enjoy free 10 minute shows of sensual videos and naughty photos without any censorship.

For similar good cam sites look at livecamlink’s list: Cam4, Camrabbit, Myfreecams, Camsoda, Bongacams, Imlive and Stripchat

How Do I Sign upon as a viewer?

The signup process for this platform has been made very easy and any adult can complete the process on their own from anywhere in even less than a minute. All you have to do is go to their page, hit the JOIN NOW button, enter a username of your choice, your email address, and create your unique password.

Once you have successfully registered to the platform, you will receive an email confirmation within 24 hours. The approval process takes an average of 2-3 hours. After you are done with this process, you will now be ready to use this platform and enjoy some of the best live adult content on the internet.

You will, however, get a prompt that will give you the option of upgrading your account to a premium plan. If you are not interested in becoming a premium member, then you can still proceed to use the free version of LiveJasmin.

In comparison to other adult platforms when it comes to the registration process, LiveJasmin does not need you to provide your picture, personal details, or even verify your email. Therefore, you can enjoy great live videos without having to worry about whether your details might be leaked out there at some point or not.

How Do I Sign Up as a Model on LiveJasmin?

You can also register on LiveJasmine as a performer where the process is slightly different as compared to registering as a viewer. There are 2 options provided when signing up as a performer.

These include either registering as a single account or registering as a studio account. A studio account gives you the opportunity to register as a couple or if you would like to register with multiple partners.

The initial registration is very easy and you will only be required to provide your email address and also create your unique password. However, after providing these details, there will be a slightly long process that you will be required to go through before you are approved or denied in accordance with their standards. Once you are done with this procedure, then you will need to provide your screen name and also choose a category you would like to perform under.

This could either be Amateur, Nude, Celebrity, or Hot Flirt. After this, you can now provide your details like your country, your nationality, your ethnicity, full name, gender, and also your birthday.

Additional details about your general appearance will also be required from you. Examples include details about your eye color, length of your hair, sexual preference, breast size, among others.

The next stage will involve you providing some documents needed to prove that you are indeed who you claim to be. Some of the documents you will be required to upload include your passport, ID, or driver’s license. These documents will then be submitted for review by the LiveJasmin moderators.

In case you meet their requirements, then you will be contacted back within the next 24 hours.

As already seen, signing up as a model can be quite a tedious process that will need you to be very patient to complete it. However, once you are done with it, the platform promises to give you 80% of the revenue that your performance brings in.

How to contact Models on LiveJasmin?

In case you just found yourself on this platform and you are looking for virtual sex with girls and also for your general viewing pleasure, then you can be sure that you have landed yourself on the right platform that will ensure you are entertained to your satisfaction.

It comes with a lot of models that offer various adult entertainment shows. Its user-friendly website is designed to make it as easy as possible for anyone to navigate through and identify a model of their choice.

You will notice that a majority of features on the platform are paid; hence you have to be ready to pay some money for you to access them. Some of the features you need to pay for for you to use them include having a Cam2Cam session with a model, giving a surprise to a model, having cam sex in a private room among other features.

Should I buy tokens or credits?

You can do this by purchasing credits on the platform that you can then use to spend on accessing these features. However, you do not have to worry about spending your money on a model that you wouldn’t end up liking.

This is because the platform offers you 10 free minutes that you can use to view a model before deciding if the model is worth your money and time.

If so, then you can proceed to spend your money on the model and view more of their shows. On the other hand, if you do not like the model, then you can simply opt-out and move to the next model without having to spend a single coin.

Also, the best thing about this website is that it ensures all your sessions are live and that you do not get engaged in pre-recorded shows.

What sort of models will I find?

By using this platform, you can rest assured that all your sexual fantasies will be addressed due to the diverse nature of categories to select from. Whether you are into couples, males, females, live orgasm, anal fantasy among other things, then you have not been left out since this platform has a huge database of models from all over the world that you can choose from to satisfy your fantasies.

These models are usually categorized in terms of preference and you also get a chance to vote for your favorite models so that they may be featured in the “Awards” section of the platform.

What Are The Features of LiveJasmin?

When it comes to true interaction, LiveJasmine is considered one of the best in the world. This is because the website always goes to great lengths to ensure that you get some of the best interactive experiences on the internet.

Keep reading to find out some of the special features LiveJasmine has put in place to ensure you end with great interactions with their models (Min 18 years old).

Can I Send surprises?

On LiveJasmine, you will be provided with the opportunity to send a surprise in the form of a virtual gift to the model you are currently watching as one way of interacting with them.

An example of a surprise can be a virtual gift in the form of a flower bouquet that costs only one credit. Some gifts also do not come cheap on this platform like a car gift which will cost you a total of 5,000 credits.

VibraToy

This is a feature that allows a female or a male model to use a VibraToy to entertain you. It is usually offered as an extra service to models’ viewers. As a viewer, you will also get a chance to control this device from the comfort of your room by just moving your mouse.

However, you will be charged an additional per-minute fee for you to use this service.

The device works by using Bluetooth for it to connect to the computer and it is also able to perform multiple tasks that might include vibration and rotation.

The models who own this device usually have their profile updated with a special badge as an indication; therefore you can always tell if a model you are watching offers this extra service or not.

How Are Private Shows?

This is a feature that will let you share a private room with a model.

This way, you can rest assured that the model is performing for only you and also the performance will be done in secret.

For you to access this feature, you will be required to purchase it by using your credits. It is also important to note that a majority of these shows usually involve more explicit and carnal performances as compared to the ones you might have seen the models performing in their public spaces.

In most cases, the female models are usually paid more for this feature since most clients are male viewers who come looking for sensual videos and also to engage in cam sex.

Cam2Cam

LiveJasmin also gives you a chance to engage in a 2-way video interaction with its models via the Cam2Cam feature. This means that you can share your camera feeds with any model you are interacting with.

You will get to see her in your private chats and she will also see you at the same time. For you to use this feature, you will be required to click on the webcam icon that can be found on the broadcast of the model you are interacting with.

Another important thing to note when using this feature is that it requires you to use your credits; hence you should make sure that there are enough credits in your account for you to take full advantage of the Cam2Cam feature. This feature is also only accessible in private chat rooms because most of the interactions usually entail cam sex.

Games

Besides engaging in cam sex and watching sensual videos, you also get a chance of playing games with models of your choice. You will also be required to have enough credits in your account for you to enjoy this feature.

It is a great feature to use whenever you are looking to get to know and build rapport with the model of your choice.

How Is The LiveJasmin Mobile App?

This site claims that they have a mobile platform that you can use to enjoy most of its features. However, if you head to the Apple App Store or the Google App Store, you will notice that this app is not included there.

However, if you wish to use the app, then it is advisable that you go to their website where you will find it listed there and available for download.

There is no need for you to worry if you fail to find the app from your mobile phone’s app store since you can always download it from their website to ensure that you end up with the legitimate app.

Avoid downloading this app from any other website apart from the official LiveJasmin website so that you may avoid ending up with a corrupted or fake app.

Upon downloading this app, you will notice that it is packed with all the features that come with the desktop version of the Livejasmin site.

When it comes to the user interface, the app has maintained the desktop’s red color making them as similar as possible; hence you can be sure not to expect a lot of differences between the app and the desktop version.

Its interface has a perfect blend of simplicity and an aesthetic look that will appeal to both young and old users. The only noticeable drawback about the app is the fact that it is not available in the most popular app stores; leading to a lot of users assuming that there is no mobile version of the platform.

What Are LiveJasmine Costs?

| Number Of Credits | Cost (USD) | Total Cost (USD) |

| 28 | $1.21 per credit | $33.99 |

| 68 | $1.12 per credit | $75.99 |

| 98 | $1.09 per credit | $106.99 |

| 158 | $1.08 per credit | $169.99 |

Credits are considered the currency of the LiveJasmin platform. In order for you to access some features on the website, you will be required to purchase credits which can then be used to pay for these features.

Some of the features that you can buy using these credits include chatting in private rooms with models, taking snapshots, buying surprises for the models, playing games with models, using your mic and camera for a one-on-one conversation with a model of your choice among other features.

Can I get free chats?

However, you can also enjoy some features that are available for free and if you get impressed with the platform, you can then proceed to purchase credits for more features.

Some of the free features that you can enjoy on LiveJasmine include adding models to your favorites, chatting with models when on their live broadcasts, voting for models for them to be awarded, viewing free 10 minutes broadcasts by models among others.

When it comes to paying or buying your credits, then there are several payment options to choose from including Paypal, Bitcoin, Credit card, bank transfer, and Direct Debit.

Our Final Conclusion

LiveJasmine has been in existence for a very long time and it has gained a lot of trust from many people across the world. With more than 10 years of operation, this platform has seen the rise and fall of most of its competitors while it has managed to always stand strong.

This only goes to show how dedicated this site is and also the great and wide variety of exciting services they offer their users.

If you are on the lookout for a website that comes packed with a wide range of adult entertainment that includes stunning models and also different categories to match each person’s fantasy, then you will not be disappointed with this platform.

You can also rest assured that you will not be scammed in any way because LiveJasmine always goes the extra mile to make sure that they have strict policies in place that their models have to adhere to.

One thing you can be sure about is that all your shows will be live and you will not end up being served with pre-recorded shows.

FAQs

How does LiveJasmin work?

This is an adult entertainment site where you get the opportunity to meet and interact with either porn stars or amateur models from across the globe. These models usually interact with users from the comfort of their homes or studios.

The interactions are either in the form of voice, text, or video. There is a wide range of models offering various virtual adult entertainment services according to your taste. You can search for a specific type of model in terms of age, appearance, specialties, language spoken, and quality of video among others.

Can I get free Credits on LiveJasmin?

Whenever you are registering on this platform, you will be provided with the option of buying a package that comes with additional free credits. However, it is important to note that this option is usually only available when you are looking to make a new purchase and also if you are a first-time user.

When you only register for a new account, then you aren’t considered as a new user.

You are also able to see the total number of purchases that you will be required to make for you to receive a bonus package. If you are purchasing via phone purchases or CCBill, then the bonus credits option will not be available for you.

These bonus credits are usually considered to be part of the full credit package; hence once you have spent them on the website, there will be no refund of any form.

Why is my account limited and I am a Livejasmin Premium Member?

This could be as a result of you not purchasing any credits for a period of 30 days or more. The account remains limited until the time you make another purchase.

The implications of a limited account include not being able to engage in LiveJasmine Chat and also not being able to view photos from some of the models. For you to get rid of the issue, you can simply purchase more credits and your account will be back to normal.

Are all the performing models on LiveJasmin live?

Yes, you can rest assured that all the models you see and interact with within the chat rooms are live and not pre-recorded.

How does LiveJasmin’s Cam2Cam feature work?

This is a feature that allows you to share all your camera feeds with the model you are currently interacting with within a private chat room. For you to enable this feature, you will be required to click on the camera icon that is located beside the model you are interacting with.

This feature, however, will be charged on a per-minute basis. It is very important to put in mind that the feature is made available only on HTTPS/SSL websites. Therefore, in order for you to access the feature, you should make sure that the URL of the website you are using has HTTPS at its beginning.

What is the process of purchasing additional credits on JasminLive?

This is a very quick and simple process. For you to proceed, you will be required to verify that you have indeed logged in and then head to the top of the page and click on the link “Get Credits”.

You will then be able to choose a payment method of your liking, the package you wish to purchase, and then enter the required details for you to complete the purchasing process.

However, you can also get this option whenever you want to engage in a private show when participating in the private show, and even after the private show.

Is it possible to check the balance of my credit?

You can do this by heading to your menu, clicking on your username, and then selecting credits. This can also be done from the top of the page by selecting “Get Credits”. You will then be able to see the total number of credits that you still have.

How can I see other models apart from the “girls” displayed by default?

For you to view other models, you will have to do it by changing your main or current category from the menu.

You will then have to choose from a range of categories that include Lesbian, Gay, Boy for Girl, Fetish, Mature Woman, Girl, Soul Mate, Hot flirt, Transgender Models, or even couples. You can also find the type of model of your choice by typing your keywords in the search bar.

How do I send a message to any model on LiveJasmin?

For you to send messages to the models of your choice, then you have to be a premium member. If you are a premium member, you will get a chance of sending messages to any model. The cost of sending a standard-length private message on LiveJasmin is 1.2 credits per message.

How can I gain access to the list of my favorite models?

For you to access your list of favorite models, you will be required to click on the heart icon that is located on the left side of the Live Cams page. To access any model from the list, you can click on the model’s thumbnail. Click on the model’s heart icon for you to remove the model from your list of favorites.

Is it possible to cancel my membership from LiveJasmin?

Yes, this is possible. However, for you to do so, you will have to contact their customer care either through their live chat or by sending them an email with the request.